Interest earned in the account is tax free. Unused contributions can be rolled over to the next year.Īllowed but includes tax withheld plus 10% penalty Employers may set a maximum rollover limit. Unused contributions may be rolled over to the following year.

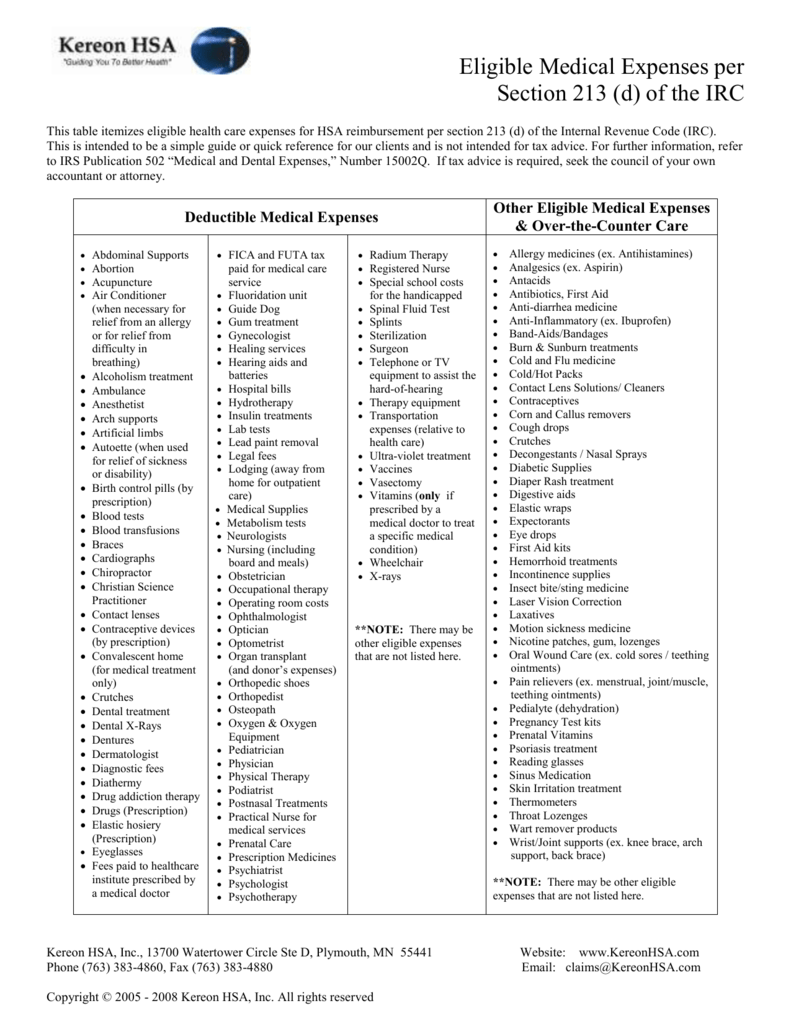

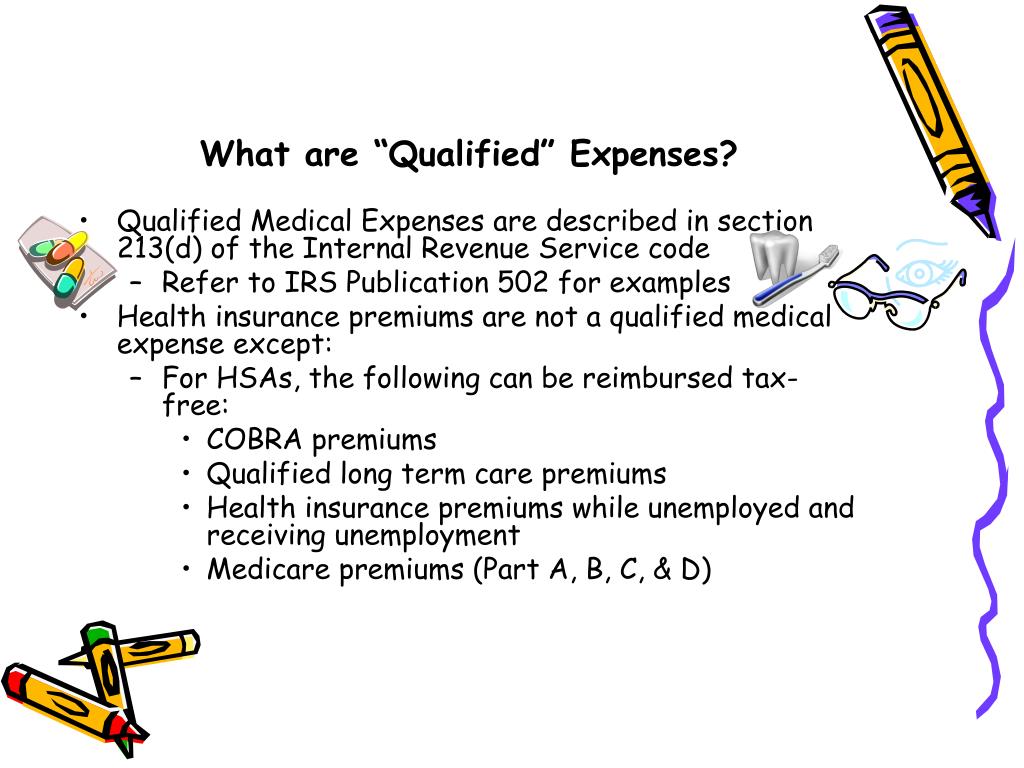

Catch-up contributions (for ages 55 and older) are limited to $1,000. Individual-coverage HRAs and qualified small employer HRAs have different rules.įor 2022, individuals can contribute up to $3,650 (rising to $3,850 in 2023). Qualified medical expenses include acupuncture, ambulance service, blood sugar test kits and strips, chiropractic therapy, hearing aids and batteries, infertility treatments, X-ray fees, dental and vision exams and treatments, and co-insurance plan fees.Įmployers that offer traditional group health insurance can offer excepted benefit HRAs and reimburse employees for up to $1,800 a year (in 2022) in qualified medical expenses. All employees in the same class must receive the same HRA contribution.Įmployed and self-employed workers with a qualified high-deductible health plan can create an account and contribute.ĭepending on the type of HRA, funds may be used to reimburse qualified medical expenses and health, vision, and dental insurance premiums. The plan reimburses employees for medical expenses incurred up to a certain amount. Health Savings Account (HSA)Įmployers decide the employment categories (e.g., full-time or part-time workers) covered and how much they will put into the HRA.

Health Reimbursement Arrangement (HRA) vs.

0 kommentar(er)

0 kommentar(er)